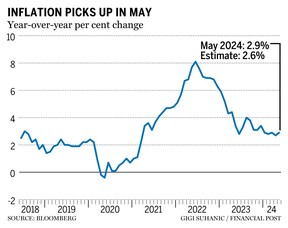

Canada’s inflation fee accelerates to 2.9%

The market now expects a 40% rate of interest minimize subsequent month, down from 60%.

Article content material

The inflation fee accelerated in Might to 2.9% year-on-year Statistics CanadaIt will shock economists who had been anticipating a decline from the two.7 p.c enhance in April.

Utility prices had been the most important contributor to the CPI rise, with costs rising 4.6 p.c final month, after a 4.2 p.c enhance in April, pushed primarily by quicker progress in costs for cell phone providers and journey. Excursions, leases and air transportation.

Commercial 2

Article content material

Grocery costs rose barely by 1.5 p.c 12 months over 12 months, in comparison with the 1.4 p.c enhance in April, and confirmed their first acceleration since June 2023. Grocery costs additionally rose month over month by 1.1 p.c, primarily as a consequence of Elevated costs of contemporary greens, meat, contemporary fruits and non-alcoholic drinks.

Shelter costs additionally accelerated month over month, rising 0.4 p.c in Might in comparison with April. On an annual foundation, it rose by 6.4 p.c. Mortgage curiosity prices stay the primary contributor to inflation, rising by 23.3 per cent year-on-year, adopted by lease at 8.9 per cent.

Earlier than Tuesday’s launch, economists had anticipated inflation to ease final month, leaving room for a number of rate of interest cuts by the Financial institution of Canada this 12 months. The newest information might restrict these expectations.

“Canadian central bankers stated they needed to see extra of the identical, however that is not what they obtained in at present’s inflation numbers,” stated Jamie Jane, chief economist at Desjardins Group. “Opposite to expectations for a slight enhance of 0.3 per cent, headline costs rose by 0.6 per cent in Might.”

Article content material

Commercial 3

Article content material

Editorially really helpful

-

Financial institution of Canada fee minimize might rely upon inflation information

-

The place traders ought to do if excessive inflation turns into the norm

Measures of core inflation, the info that Financial institution of Canada policymakers desire to think about when making financial choices as a result of it filters out excessive value adjustments, noticed small will increase. The patron value index rose 2.9 p.c year-on-year in Might, in comparison with 2.8 p.c in April. The common CPI additionally noticed a slight enhance of two.8 p.c final month, in comparison with 2.6 p.c in April.

“Total, with the info displaying value pressures a lot quicker than anticipated, this casts quite a lot of doubt on the potential for a July minimize,” Catherine Goudge, an economist at CIBC Capital Markets, stated in a observe after the info.

Gan stated the market was now pricing in a 40 p.c probability of a fee minimize subsequent month, down from 60 p.c earlier than the brand new inflation information was launched.

“This CPI report is just not the loss of life knell for rate of interest cuts in July,” stated Jules Boudreau, chief economist at McKinsey Investments. “Reducing rates of interest at a gradual tempo is important to revive a faltering Canadian economic system that’s lagging the efficiency of all its world friends.”

Commercial 4

Article content material

Statistics Canada will launch April GDP information on Friday, and the most recent unemployment information is predicted subsequent week. Policymakers will monitor these numbers earlier than making their subsequent rate of interest resolution on July 24.

“Governor Macklem might need to maintain off on calling for a tender touchdown, no less than for now because the Financial institution of Canada will probably wait to see how the economic system progresses and pause at its subsequent assembly,” Andrew DiCapua, a senior economist on the Canadian Chamber of Commerce, stated in a observe. “. “The Board stays too data-driven, and this reversal will assist their restrictive bias.”

Bookmark our web site and assist our journalism: Do not miss the enterprise information you could know – add Financialpost.com to your bookmarks and join our newsletters right here.

Article content material